UltraFast and Smart insulins: What’s coming, maybe?

3 years ago, the DIY Loop and Learn community hosted Dr. Michael Weiss, from I ndiana University and founder of Thermalin, to discuss his work on smart insulins. I’ve reached out for an update … no news yet but I’m always hopeful. Synthetic hinge could hold the key to revolutionary “smart” insulin therapy

ndiana University and founder of Thermalin, to discuss his work on smart insulins. I’ve reached out for an update … no news yet but I’m always hopeful. Synthetic hinge could hold the key to revolutionary “smart” insulin therapy

-

-

- Cass Pharmaceuticals, based in Tennessee, is working on rapid-onset insulin analogs as well as glucagon, the counter-regulatory hormone of insulin. Cass Pharmaceuticals

- Abvance Therapeutics is working on a co-formulation of short-acting insulin and glucagon, as a “smart” insulin. Abvance Therapeutics

- Novo Nordisk is working on something called “ideal pump insulin” or “Pumpsulin”. As reported in their 2022 annual report, dated 1 February 2023: “Innovation and therapeutic focus – Phase 1 trials with Ideal Pump insulin successfully completed” And reported on Pharmaceutical-Technology.com, 27 November 2023: What is the current valuation of Novo Nordisk’s Ideal Pump Insulin?

- A study in Nature Chemical Biology, University of Copenhagen biologist Helena Safavi-Hemami probed the peculiar anatomy of the Kinoshita’s cone snail’s insulin. The researchers incorporated unique regions of the molecule into human insulin, creating a hybrid that lacks the human version’s clumping region. Venomous Snail Unlocks New Diabetes Drugs

-

And what is the reality of a newer, faster, smarter insulin coming to market?

Shared with me by a renowned endocrinologist/researcher and T1D himself, “The big insulin manufacturers who had previously been pumping money into R&D are pulling back with the bloody nose they got on insulin pricing and the success of GLP1s. Commercializing a drug for diabetes is a MASSIVE expense, so even with the best ideas – the clinical trial is a colossal undertaking unless you are Lilly, Novo or Sanofi. At present, people are buying their insulin, they are locked into those 3 manufacturers and any research would just cost them the 10 times profit they are making. They have very little motivation to move the needle.”

I welcome comments or suggestions for how we all might advocate for these much-needed innovations.

What to know about using non-insulin agents in type 1 diabetes by Susan Weiner for Healio.com/endocrinology, 7 December 2023.

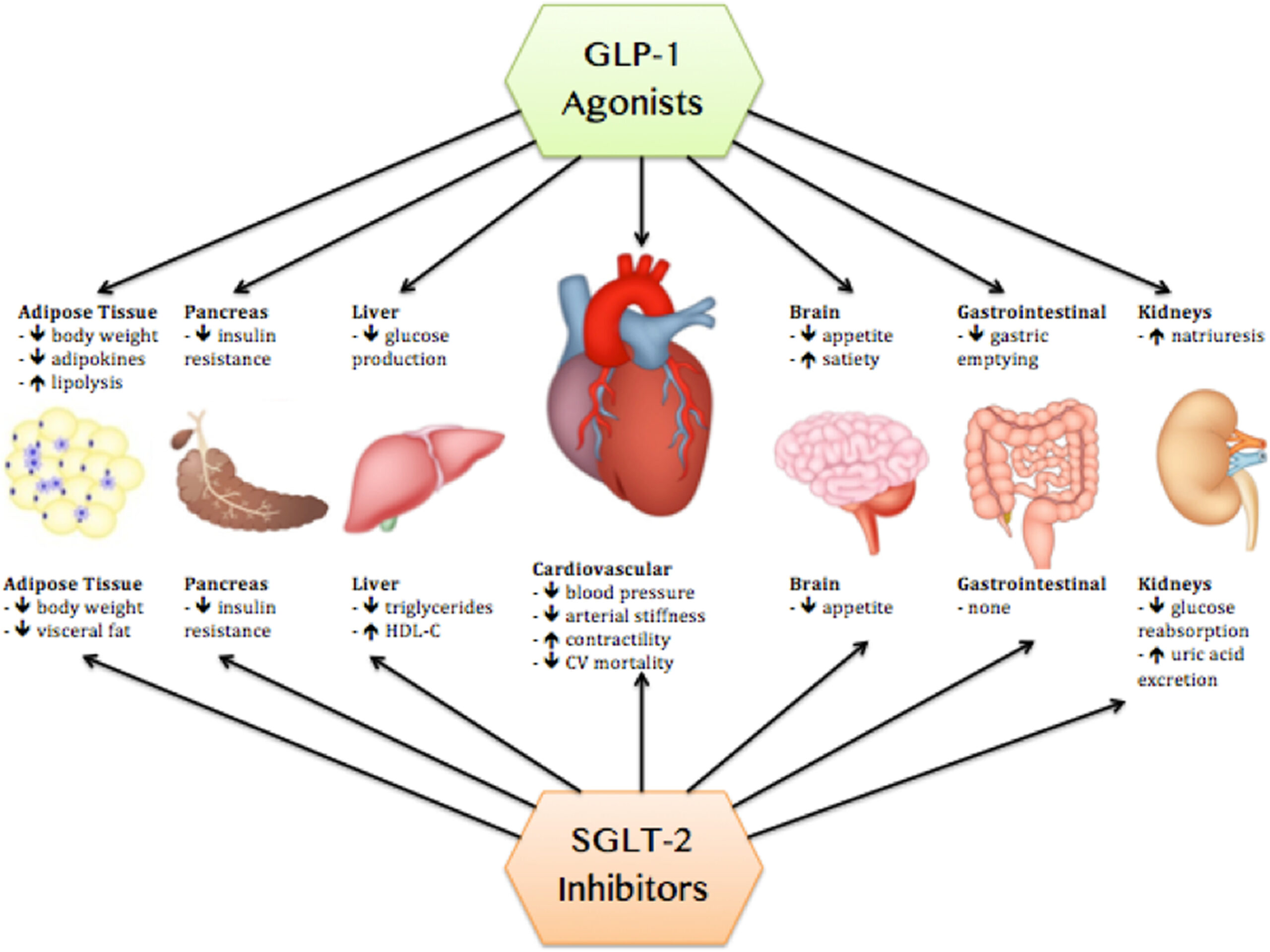

Susan Weiner, MS, RDN, CDCES, FADCES, asked Joshua J. Neumiller, PharmD, CDCES, FADCES, FASCP, about nuances of using SGLT2 inhibitors and GLP-1 receptor agonists in type 1 diabetes, and therapy for delaying type 1 diabetes onset. People with type 2 diabetes can benefit greatly from using SGLT2 inhibitors and GLP-1 receptor agonists, alone or in addition to insulin. Can people with type 1 diabetes benefit from these agents?

Susan Weiner, MS, RDN, CDCES, FADCES, asked Joshua J. Neumiller, PharmD, CDCES, FADCES, FASCP, about nuances of using SGLT2 inhibitors and GLP-1 receptor agonists in type 1 diabetes, and therapy for delaying type 1 diabetes onset. People with type 2 diabetes can benefit greatly from using SGLT2 inhibitors and GLP-1 receptor agonists, alone or in addition to insulin. Can people with type 1 diabetes benefit from these agents?

Neumiller responded: Studies with SGLT2 inhibitors in people with type 1 diabetes have reported modest reductions in HbA1c, modest weight loss, and the ability to reduce background bolus and basal insulin doses. Similarly, studies of GLP-1 receptor agonists demonstrated modest reductions in HbA1c, an ability to down-titrate background insulin doses and modest weight loss.

Neumiller also commented: In the case of SGLT2 inhibitors, an important safety consideration is a risk for the development of diabetic ketoacidosis. SGLT2 inhibitor-associated DKA can uniquely present as euglycemic DKA, where the individual does not present with severe hyperglycemia as is typically expected with DKA. In the case of GLP-1 receptor agonists, people with type 1 diabetes can experience many of the same adverse events that are seen among people with type 2 diabetes, such as gastrointestinal effects and injection site reactions. The addition of GLP-1 receptor agonists to background insulin can also place people with type 1 diabetes at risk for hypoglycemia.

Read more:

Kickbacks and formulary exclusions for CGMs by Riva Greenberg for DiabetesStories.com, 16 December 2023.

Riva Greenberg writes: My friend Scott Strumello, probably the smartest diabetes advocate regarding tech, costs, and insurance policies, sent me the heads-up below, regarding costs and coupons for Dexcom and Freestyle Libre CGMs.

Riva Greenberg writes: My friend Scott Strumello, probably the smartest diabetes advocate regarding tech, costs, and insurance policies, sent me the heads-up below, regarding costs and coupons for Dexcom and Freestyle Libre CGMs.

From Scott: I have been (putting it nicely) perturbed by the fact that my own insurance company (Aetna’s PBM Caremark) is receiving legally exempted rebate kickbacks contingent upon “formulary exclusion” for any CGM that is not DEXCOM brand, which basically means Abbott Freestyle Libre.

Read more:

MERRY HOLIDAYS and best wishes for a season of gratitude, and kindness and paying it forward with appreciation, hugs, and love from TheSavvyDiabetic (Joanne, Richard and Hey Buddy)!

I’ll be taking the week off until after the new year … recovering from a second surgery and just enjoying the beauty of the season!

Scott is correct about many things (I think I am a pretty good expert on insurance), but why quibble? Undeniably, PBM’s use of rebates has bent the marketplace to be so off-kilter that it is no longer a marketplace. Instead, it is more like a cartel controlled by the mafia, which is legally sanctioned. I do not begrudge PBM’s making money, far from it. However, when they add as much as 100% to the cost of a product (look at insulin) and then give plan sponsors less than 50% back, it is an absolute travesty.

Remember, PBM’s charge plans a per capita monthly charge. Plans typically pay $4.00 to $9.00 per covered employee per month to the employer plan. Then they hijack costs and beat their chests when they give a penitence back to the employer.

Let’s instead understand that if they changed $10.00 per covered employee per month and were responsible for lowering prices using bulk buying and intelligent management, we would have far lower prices for employers and employees and still give a fair return to manufacturers. Who would lose money? The PBMs have a relative monopoly stranglehold on pricing.

Ahh, don’t get me started. (Ahh, too late)