4 Out Of 5 Americans With Diabetes Went Into Debt To Pay For Insulin was contributed by Deb Gordon for Forbes.com, 20 June 2022.

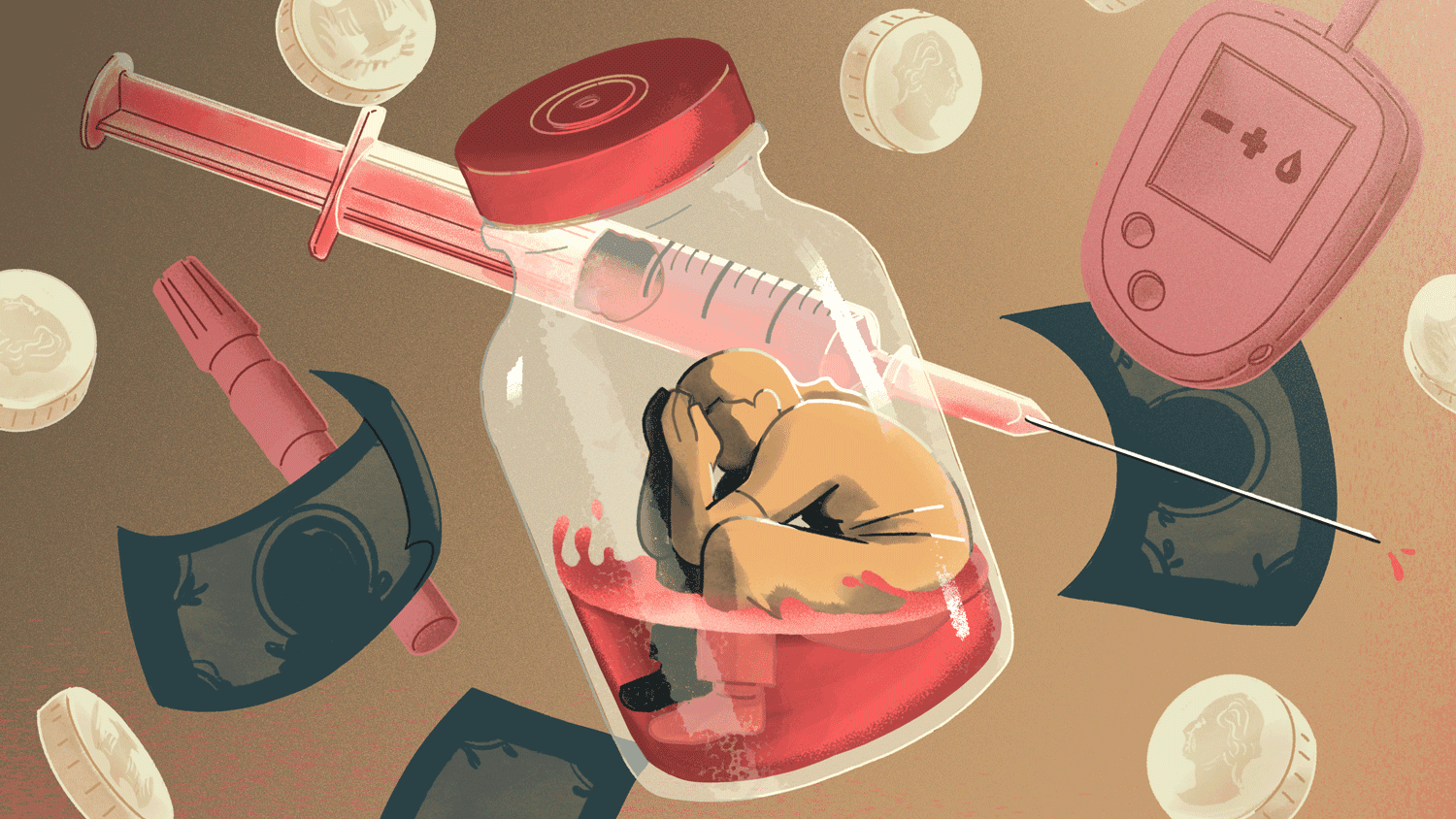

According to a new study, released in earliy June from CharityRx, 79% of U.S. adults who have diabetes or care for someone who does say paying for insulin has created financial difficulty. Four out of five people surveyed reported having taken on credit card debt to cover those costs, with the average credit card debt. The survey revealed that many people with diabetes face potentially unpleasant or difficult trade-offs because of the cost of insulin.

According to a new study, released in earliy June from CharityRx, 79% of U.S. adults who have diabetes or care for someone who does say paying for insulin has created financial difficulty. Four out of five people surveyed reported having taken on credit card debt to cover those costs, with the average credit card debt. The survey revealed that many people with diabetes face potentially unpleasant or difficult trade-offs because of the cost of insulin.

Of those surveyed who have struggled financially due to the cost of insulin, 83% said they were afraid of not being able to pay for living expenses as a result. About half said they’ve cut their spending on clothing (55%) or food (50%) to be able to pay for insulin. Nearly one-third (29%) said they’ve had to adjust rent or mortgage expenses. Another 63% said they’ve felt pressure to sell possessions and half said they’ve put themselves in risky situations to get money for insulin. About a third of respondents (32%) said they’ve had to sell prescriptions or illicit drugs to get the money they need to pay for insulin.

Perhaps even more concerning are the strategies survey respondents reported using to stretch out their insulin. For example, 62% of survey respondents reported skipping and/or adjusting their insulin dosage to save money.

Read more: 4/5 of Americans With Diabetes Went Into Debt To Pay For Insulin

How Hydration Affects Blood Sugar Levels was produced by Juliet Richards, Certified Diabetes Educator and Founder of TheDiabetesandHealthClinic.com, 2021.

There are lots of reasons why drinking plenty of water is good for your health but did you know being hydrated or not can affect your blood sugar levels? Terry O’Rourke on TuDiabetes.org said, ” This video does a good job of explaining the metabolic details of staying hydrated. I learned some things I didn’t know before.”

Love the hydration video. Hate medical debt for insulin. Boo for that.