This is just outrageous! I just have to share … and ask for wisdom.

I take a medication for inflammatory arthritis … and I am covered by Medicare. Medicare is prevented from “negotiating” drugs pricing, due the the Kickback laws. If a drug company discounts medications to Medicare customers, it is viewed as a bribe. Those under commercial insurance policies are not restricted that way.

I take a medication for inflammatory arthritis … and I am covered by Medicare. Medicare is prevented from “negotiating” drugs pricing, due the the Kickback laws. If a drug company discounts medications to Medicare customers, it is viewed as a bribe. Those under commercial insurance policies are not restricted that way.

SO … I get to pay $1591 for a one month supply (while in the Initial Coverage and “Donut Hole” coverage), which is about 25% of the negotiated list price. It goes down to 5% of the list price only after I am $8000, out of pocket.

THAT’S RIDICULOUSLY EXPENSIVE, given that those with commercial insurance can pay $10-20 copay per month! $1591 vs $10??? Who benefits with this plan? Certainly the PMBs and drug manufacturers are making $$$.

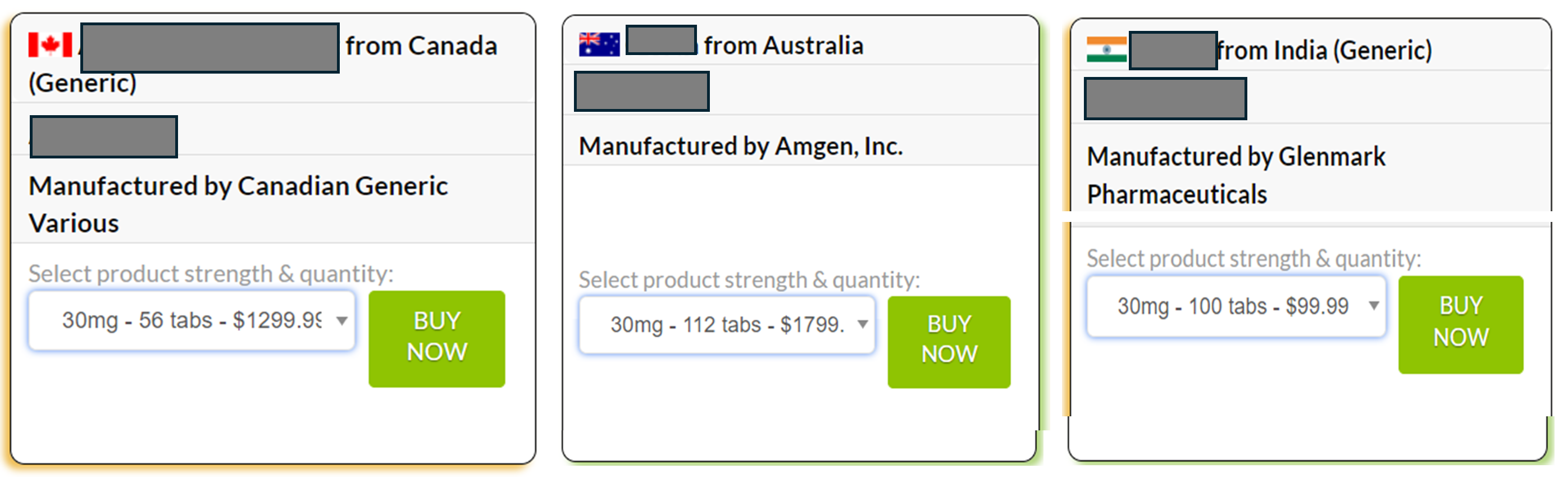

I started searching … and found that the cost of the same generic medication from Glenmark Pharmaceuticals in India is WAY LESS! Through a Canadian pharmacy, I can pay $33/month!  I was wildly lucky to have a friend who is visiting her family in India this week. She went the a local pharmacy and picked up, WITHOUT PRESCRIPTION, a 3-month supply (180 tablets) for $68!!!!! That is $23/month or $0.76/day!

I was wildly lucky to have a friend who is visiting her family in India this week. She went the a local pharmacy and picked up, WITHOUT PRESCRIPTION, a 3-month supply (180 tablets) for $68!!!!! That is $23/month or $0.76/day!

Why are drugs THAT MUCH CHEAPER in India?

It’s a mandate focused on generic medications. The government of India has taken an initiative for free supply of essential medicines in public healthcare facilities in the country aiming to provide affordable health care to the people by reducing out of pocket expenses for medicines. This initiative has been undertaken to promote rational use of medicines and reduce the consumption of unscientific and hazardous medicines. Read more: Essential Medicines: An Indian Perspective

There is one outstanding question: What is the quality of the generic meds from India? I just don’t know but I’ll find out.

SO … how do I manage my extreme outrage and frustration? How do I affect change?

I’m open to any suggestions or ways to sound the alarm and get some action and attention! Our system in the US is broken and while there are some steps to begin to remedy the situation. But this is just simply crazy!

I totally agree with you and understand your rant as I too end up in the “donut hole”. Our whole medical and pharmacy”systems” are not working well at all. It is way too complex and overwhelming as well as expensive for patients. Thankfully the donut hole is changing this year and next.

I’m outraged reading this but, unfortunately, not surprised. I wish I could offer useful advice but I’m so overwhelmed by the ridiculousness of the medical system myself, all I can write is that many of us are in a similar situation and we’re all sick of it! I hope you keep up the good fight and eventually something will have to change.

Just know that in 2025 things should get better, if we do not allow Congress to change the medicare law.

In 2025: people with Medicare Part D will have an annual limit, capping their out-of-pocket prescription drug costs at $2,000. In the years that follow, annual limits will be adjusted based on inflation.

However, that cap and date is under assault in Congress. We need to hold this and who we elect this year will make all the difference. If you care about this subject, we must press our congressional candidates and make this a qualifying test for a vote for president.

Oh and in addition, we did get a change this year.

Beginning January 1, 2024, the five percent prescription cost-sharing obligation in the catastrophic phase for Part D will be removed. According to a 2022 Kaiser Family Foundation brief, Part D enrollees who take only brand-name drugs in 2024 will have a cap of about $3,250 for calendar year 2024.

Both of these are part of the inflation reduction act.

Wow! That’s crazy. I’m constantly dumbfounded by the wide variation in drug pricing even within the US. I have no idea how we solve this problem and make necessary drugs attainable to those who need it.

This insanity is an issue I have been fighting for over a decade now. Personally, I am optimistic of what could happen once the U.S. Federal Trade Commission (FTC) study of Pharmacy Benefit Manager “business practices” concludes because that business is entirely driven by legally-exempted rebate kickbacks. That said there ARE some tools which can help you as a patient navigate a severely broken U.S. prescription drug distribution system. I found the NPR podcast “An Arm & A Leg” published a “toolkit” (see https://firstaidkit.substack.com/p/avoiding-prescription-drug-ripoffs for more) on avoiding prescription drug ripoffs. Among them now include Mark Cuban Cost Plus Drug Company, GoodRx (and at least a dozen rival coupon-generating websites/apps – most powered by the same PBMs driving prices higher in the first place), but it’s important to acknowledge that peer-reviewed academic research has found that about a quarter of the time, it is actually cheaper for patients to bypass their own insurance pharmacy benefit (or Medicare Part D administrator) and to just pay cash for prescriptions, especially on generic medications which tend to be subject to the most egregious PBM “pricing arbitrage”. One challenge is that the strategies of companies operating in the space are ever-changing. For example, I have removed the coupon-generating website/app OptumPerks from those I now check prices on. The reason is because United Healthcare Group’s PBM OptumRx is no longer even affiliated with the coupon-generating website/app known as OptumPerks, and its drug prices reflect that. United Healthcare sold the OptumPerks business to a limited liability corporation a number of years ago but I now find it worthless. On Cigna/Express Scripts’ InsideRx, it still works, but patients can no longer order scripts from Express Scripts Cash-Pay Mail Order Pharmacy which means options in terms of pharmacies which offer the lowest prices have been reduced. One worth looking at is one no one has heard of: CapitalRx Advantage Savings https://capitalrxadvantage.com/ which is from a rapidly-growing startup PBM known as CapitalRx competing with the likes of Cigna’s Express Scripts, United Healthcare’s OptumRx and CVS Health’s Caremark PBM business. However, CapitalRx operates a unique NADAC cost-plus pricing model for its clients (and by extension, via its coupon-generating website/app), charging its PBM clients a fixed, flat fee per prescription claim processed rather than “spread pricing” (PBM arbitrage) proprietary rebates off the average wholesale price or wholesale acquisition cost. Another interesting one is operated by the drug wholesaler known as McKesson which operates a coupon-generating website (its app is no longer functional) known as ScriptHero https://www.scripthero.com/ which is powered by its owned CoverMyMeds unit (since 2017). A new thing is to consider both “authorized generics” made by the manufacturer to bypass PBM-driven price inflation, and also to seriously consider brand-name manufacturer coupons, many of which never expire but may have restrictions on those covered by Medicare (some do offer discounts to cash-payers, which Medicare covered patients may use as long as they do not submit the drug purchase as a Medicare claim). I covered a number of these on my own blog a while ago at https://blog.sstrumello.com/2022/07/turning-pbm-arbitrage-on-its-head.html. The challenge is every drug must be looked at independently and prices can and do change, at which point, you have to start the process all over. Bottom line: no one tool will work for every prescription, and even then, one tool may only work for a limited time. In that way, I think the Mark Cuban Cost Plus Drug Company model is vastly superior, and they make a big deal when the reduce drug prices (and they’ve been known to do so a few times a year when their prices fall), but it’s like an investigation for every drug all the time. My rules are NEVER trust the price you are asked to pay at the pharmacy on prescription drugs unless you think it is fair. Odds are, that’s not the “real” price and unless it’s only a few dollars, only suckers pay that amount. Search at least 5 or 6 reputable prescription drug price comparison/coupon-generating websites/apps. Beware when buying generics. I’m not suggesting there’s anything inherently wrong with generic drugs, but PBM price gamesmanship is extremely high on generic drugs. You are likely to find it elsewhere for much less except when it’s part of a special drugstore list of $4 generic drugs. Others may be corruptly overpriced. Know that you can bypass your own insurance plan’s PBM and use a different PBM and get better prices on some generics. Finally, I suggest that lowest-price should likely win your purchase business. Loyalty really has no place when the prices are never the same for any two customers at the same store. Again, lowest price wins.

Great discussion, Scott. However, a HUGE issue applies to those covered by Medicare. I don’t know the stats but I’d safely guess that most of the most expensive arthritis meds are prescribed for those over 65. The pricing is OUTRAGEOUS. And generics don’t mostly even apply for these meds.